Our professional private equity team successfully manages a diverse portfolio of products, varying in size, region, and industry specifics.

While most of our investments focus on the Baltic region, we also pursue opportunities beyond.

INVL Private Equity Fund II is the largest private equity fund in the Baltics.

- Size after the first close is €305 million.

- Fundraising will continue to reach a hard cap of EUR 400 million.

- The fund will build on the strategy of the INVL Baltic Sea Growth Fund, seizing attractive opportunities across the Baltics, Poland, Romania and the broader EU.

Target investments include:

- the size of investment in a company – €10–40 million, with a preferred equity ticket of around €25-30 million;

- majority or significant minority stakes;

- companies with high growth potential and the ability to operate in the face of increasing global competition.

Our main product is INVL Baltic Sea Growth Fund, the largest private equity fund in the Baltic States with the European Investment Fund (EIF) as the main investor.

- Size: €165 million;

- The fund focuses on investment in the Baltic States and neighbouring regions such as Poland, Scandinavia and Central Europe;

- The fund’s mandate covers investment across the European Union.

Target investments include:

- the size of investment in a company – €10–30 million (with a lower consolidation potential, lower initial investment is also possible);

- majority or significant minority stakes;

- companies with high growth potential and the ability to operate in the face of increasing global competition.

bsgf.invl.com

Another company in our private equity portfolio is INVL Technology, a closed-end investment company listed on the Nasdaq Stock Exchange.

- Start of operation: 14/07/2016;

- Term: 10 years (+2 years);

- Capitalisation as at 30/06/2024: €32.2 million;

- INVL Technology’s Articles of Association allow the company to invest in European Economic Area, Organisation for Economic Co-operation and Development (OECD) countries and Israel. The portfolio companies implement projects in: Northern and Eastern Europe, Sub-Saharan Africa, and South and Southeast Asia.

Target investments include:

- IT companies catering to large corporations and public-sector clients;

- improvement of the business climate, e-governance, IT services and programming;

- cybersecurity.

www.invltechnology.com

INVL Special Opportunities Fund has indirectly invested in the stock of Moldova-Agroindbank (MAIB), the largest bank in Moldova.

- Fund size: €4.5 million

- Start of operation: 2018, term – 10 years

- Investment in the shares of Moldova-Agroindbank (maib).

- The aim is to transform MAIB into a leader in new standard banking services, focusing on digitization and innovation and strengthening the retail banking segment.

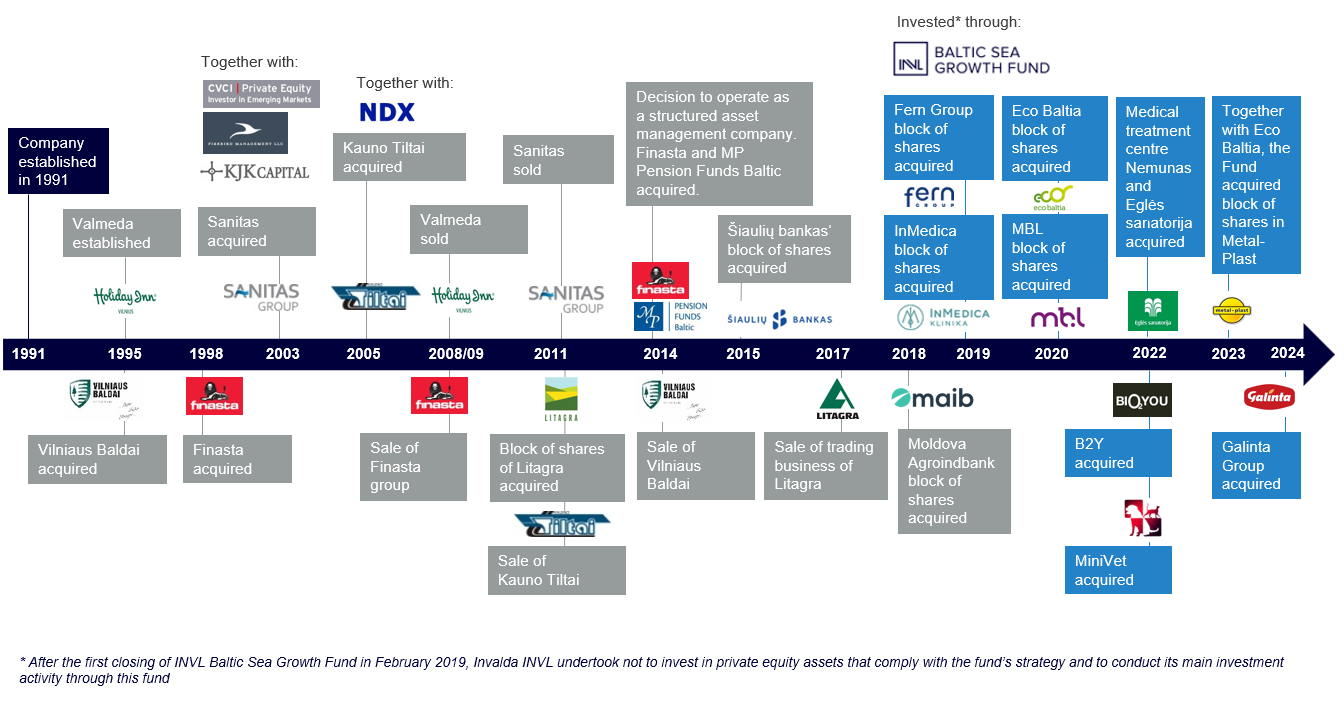

EXPERIENCE IN PRIVATE EQUITY MARKET

Since its incorporation in 1991, Invalda INVL, in collaboration with both foreign private equity funds and local entrepreneurs, has completed numerous acquisitions, sales and capital-raising transactions with a total value of over €2 billion.

https://www.invl.com/en/historical-track-record/